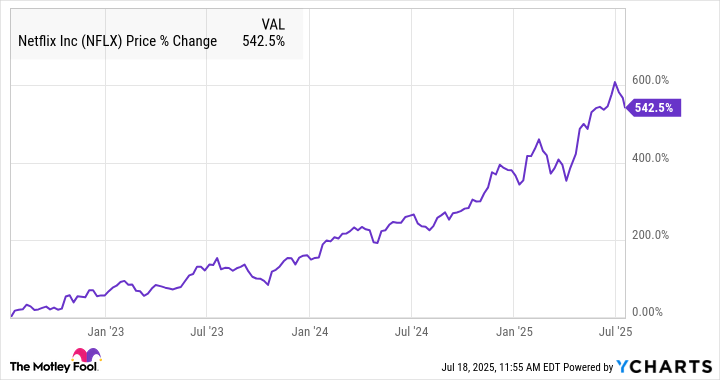

It was in the late autumn of 2022, when the rain fell relentlessly over Silicon Valley, a dampness that seemed to seep into the very algorithms of the digital world, that investors first whispered of Netflix’s decline, a prophecy of waning subscriptions and a flickering screen. They spoke of it then as if it were a certainty, a judgment rendered by the fickle gods of the market, though few could have foreseen the subsequent resurgence, the almost miraculous recovery that followed. Now, with the scent of impending macroeconomic storms gathering on the horizon like a distant, ominous fog, the question hangs in the air: can this seemingly fragile titan, this empire built on the fleeting desires of millions, truly double its share price by 2028? The numbers, as always, tell a curious, often deceptive, story.

"Покупай на слухах, продавай на новостях". А потом сиди с акциями никому не известной биотех-компании. Здесь мы про скучный, но рабочий фундаментал.

Бесплатный Телеграм каналThe initial plunge, you see, was as dramatic as a sudden summer squall. The company, once celebrated as a harbinger of the future, found itself adrift in a sea of negativity, two consecutive quarters of subscriber losses echoing like a mournful dirge through the halls of Wall Street. Yet, as one observes cyclical shifts in consumer behavior, one also knows that market sentiment can change as swiftly as the desert wind, leaving behind a trail of lost expectations and unexpected opportunities. It was then, bathed in the melancholy of a fading era, that Netflix, like a stubborn cactus blooming in the most arid of landscapes, made a deliberate pivot. Advertising, once anathema to its purist vision, was cautiously embraced, a concession to the shifting tides of necessity and economic gravity, and the thorny issue of password sharing, long avoided, was finally addressed with a pragmatic, if somewhat unwelcome, firmness. The results, as the chart below so starkly demonstrates, have been… remarkable.

To anticipate a repetition of that previous three-year surge seems, perhaps, a touch optimistic, akin to believing the river will always flow in the same direction. Still, a doubling of the stock price remains a plausible, if ambitious, objective. And the most recent earnings report offered a few… insights, fragmented glimpses into a future still veiled in uncertainty. The second quarter, a fleeting moment of relative calm amidst the wider market turbulence, brought results that were, technically, strong, yet failed to fully ignite the imagination of investors already jittery from past disappointments. Revenue grew by 16%, reaching $11.1 billion—a respectable pace that, however, merely fulfilled expectations, like a dutiful clock striking the hour. The disappearance of subscriber counts, a curious editorial decision, further obscures the true engine of growth, leaving analysts to sift through circumstantial evidence and whispered rumors. It appears, from the pronouncements of management, that the increase was borne from a confluence of factors: a modest uptick in subscribers, the burgeoning success of the advertising tier, and strategic price adjustments in certain markets. The company’s proprietary ad technology, Netflix Ads Suite, is now deployed across all territories, signifying a decisive and irreversible commitment to this new revenue stream—a conversion, one might say, of the digital spirit.

The beauty of the subscription model, as any seasoned strategist appreciates, lies in its inherent scalability. As the base grows, so too does the margin, expanding like the rings of an ancient tree. And the advertising element, a shrewd addition, further enhances profitability, allowing Netflix to tap into a more budget-conscious demographic, while simultaneously extracting greater value from its vast library of content. Operating margins, a key indicator of long-term viability, swelled from 27.2% to a more robust 34.1%, and earnings per share ascended from $4.88 to $7.19, surpassing consensus estimates, albeit by a slender margin. Yet, a shadow of caution lingers. Management, ever wary of the unpredictable whims of the market, warned of a potential contraction in margins during the second half of the year, attributed to escalating content expenditures. Full-year guidance was revised upward, from $43.5 billion to $44.8 billion, but even this upward adjustment is tempered by the recognition that content creation, like the relentless march of time, is an inescapable force.

Indeed, the entire operation possesses a disconcerting sense of momentum, a feeling that the disparate pieces – the burgeoning advertising engine, the ever-expanding content slate, the subtle refinements of its algorithmic recommendation system – are all coalescing into a single, formidable force. Millions, perhaps tens of millions, now indulge in Netflix’s offerings, consuming an astonishing 95 billion hours in the first half of the year – a slight increase, but a testament to the enduring appeal of readily available entertainment. And the company’s growing investment in local content, films and series resonating with audiences beyond the familiar shores of the English-speaking world, is proving particularly fruitful, with non-English content now commanding more than a third of total viewing hours. These are the winds of change, subtle yet persistent.

Now, to the crux of the matter: can Netflix’s share price reach $2,500? The previous ascent was propelled not only by fundamental improvements in the business—a more efficient operation, a diversified revenue stream—but also by a significant expansion in the market’s valuation multiples. The chart, though incomplete, offers a visual representation of this phenomenon. Currently, with second-quarter earnings factored in, Netflix trades at a P/E ratio hovering around 50—a premium, to be sure, particularly for a company once considered firmly entrenched in the category of mature, slow-growth enterprise. The market, it seems, is pricing in a substantial amount of future growth, and any deviation from this expectation—any hint of faltering—could trigger a swift and unforgiving correction.

To achieve a doubling of its share price, Netflix must demonstrate that it can generate earnings on its own merits, a feat that proved surprisingly elusive in the immediate aftermath of the recent earnings announcement. The ensuing sell-off, a brief but unsettling tremor in the market, suggests that investors believe much of the growth potential is already factored into the current price. The journey will be protracted, perhaps spanning more than three years. Yet, considering the company’s consistent revenue growth, its steadily expanding operating margins, and the tantalizing prospect of expansion into adjacent, unexplored business territories—gaming, perhaps, or virtual experiences—a doubling of earnings per share within the next five years seems a fair, if not entirely certain, proposition. The path forward is fraught with peril, but the destination, if reached, would be a remarkable testament to resilience and adaptation.

And so, the question remains, hanging in the air like the scent of distant rain: will Netflix reach the summit by 2028? It is a challenge, undoubtedly, one that requires not only shrewd strategy but also a measure of luck, that capricious mistress of all human endeavors. 🤞

Смотрите также

- Стоит ли покупать фунты за йены сейчас или подождать?

- Европлан акции прогноз. Цена LEAS

- МосБиржа на пути к 2800: Что поддерживает рост и как цифровизация влияет на рынок (26.01.2026 02:32)

- Российский рынок: Инфляция стихает, сырье поддерживает, акции растут (29.01.2026 00:32)

- ТГК-2 префы прогноз. Цена TGKBP

- АбрауДюрсо акции прогноз. Цена ABRD

- Серебро прогноз

- Российский рынок акций: Ожидание Давоса, отчетность лидеров и переток в металлы (20.01.2026 10:33)

- Российский рынок: Осторожность и возможности в условиях геополитики и ралли золота (21.01.2026 00:32)

- Институционалы наступают: $3Т торгов на CME сигнализируют о новом ралли (30.01.2026 07:45)

2025-07-22 10:55